Incoterms, or International Commercial Terms, are a set of standardized three-letter trade terms created by the International Chamber of Commerce (ICC) that are used in international and domestic trade contracts.

These terms define the responsibilities and obligations of buyers and sellers involved in transporting and delivering goods. Incoterms are widely used to avoid misunderstandings and disputes in international trade by providing a common set of rules.

Each Incoterm specifies the following key aspects of a transaction:

1. Delivery Point: Indicates where the risk and responsibility transfer from the seller to the buyer.

2. Transportation Costs: Specifies which party is responsible for transportation costs, including shipping, insurance, and other charges.

3. Risk of Loss or Damage: Defines when the risk of loss or damage to the goods transfers from the seller to the buyer.

4. Customs Clearance: Indicates which party is responsible for customs clearance and related formalities.

It’s important for parties involved in international trade to clearly specify the chosen Incoterms in their contracts to avoid misunderstandings and ensure a smooth and efficient transaction process. Remember that Incoterms may be updated or revised, so it’s advisable to check for the latest version if there have been any changes.

Incoterms Definition

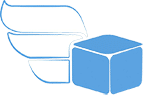

EXW (Ex Works)

EXW significantly burdens the buyer for logistics and transportation. It is commonly used when the buyer has a robust transportation network or when goods are near the buyer’s location. This Incoterm clearly demarcates responsibilities, making it suitable for experienced international traders.

- Seller’s Responsibilities:

- The seller must ensure that the goods are ready for pick-up by the buyer at a specific location agreed upon in the contract.

- This location is often the seller’s premises, factory, or warehouse.

- While the seller is not obliged to load the goods onto the buyer’s transport, they must cooperate with the buyer’s arrangements for transportation.

- The seller is responsible for export customs formalities, including obtaining licenses or permits if required.

- The seller covers all costs until the goods are made available to the buyer, but they are not responsible for costs associated with the main transportation beyond their premises.

- Buyer’s Responsibilities:

- The buyer is responsible for all costs of transporting the goods from the seller’s premises to the final destination.

- The buyer must handle loading the goods onto their chosen mode of transportation.

- Unloading at the destination is also the buyer’s responsibility.

- The buyer is responsible for import customs formalities, including clearing the goods for import.

- The risk of loss or damage transfers from the seller to the buyer once the goods are available at the agreed-upon location.

Instances when EXW is Commonly Used

- EXW is suitable when the buyer has better control over the transportation process, such as having their own transportation arrangements or using a freight forwarder.

- It is commonly used when the goods are ready for immediate pick-up by the buyer, and the buyer is responsible for the entire logistics process.

- EXW is often used in domestic transactions where the buyer is in close proximity to the seller’s location.

- Buyers who want more control over transportation costs, carriers, and shipping routes may prefer EXW.

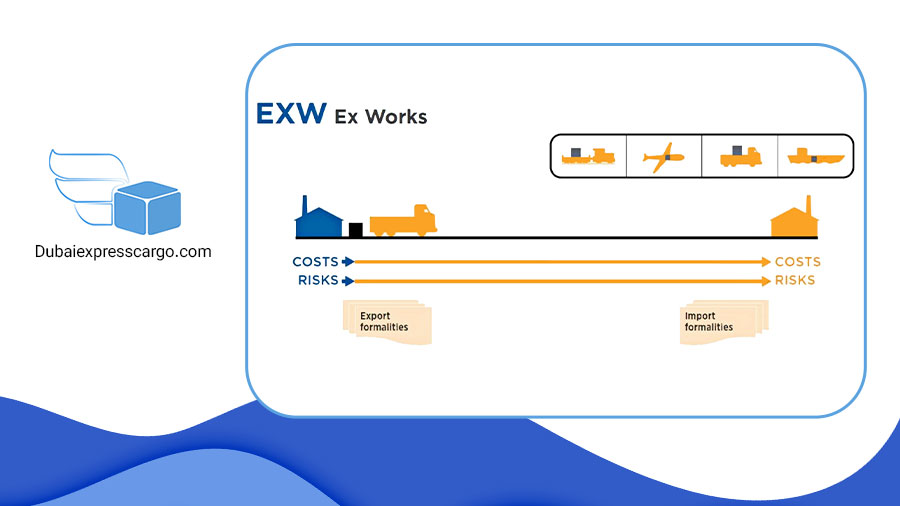

FCA (Free Carrier)

FCA is a flexible Incoterm that allows buyers to control transportation from the named place of delivery. It is commonly used in various scenarios, especially when the buyer wants to customize the logistics process and has specific preferences for carriers and transportation methods.

The clear distinction of responsibilities makes it suitable for a range of international trade transactions.

- Seller’s Responsibilities:

- The seller must deliver the goods to the agreed-upon place between the buyer and seller. This can be the seller’s premises, a terminal, an airport, or any other specified location.

- The seller is responsible for clearing the goods for export. This includes obtaining necessary export licenses or permits.

- The seller is responsible for loading the goods onto the buyer’s nominated vehicle or carrier at the named place of delivery.

- The risk of loss or damage to the goods transfers from the seller to the buyer once the goods are delivered to the carrier at the named place.

- Buyer’s Responsibilities

- The buyer is responsible for contracting and paying for the goods’ transportation from the named delivery place to the final destination.

- The buyer is responsible for import customs formalities, including clearance for import and payment of any import duties or taxes.

- The risk of loss or damage to the goods is transferred from the seller to the buyer once the goods are delivered to the carrier at the named place.

- The buyer is responsible for the costs of unloading the goods at the destination.

Application of FCA in Different Scenarios

- FCA is suitable when the buyer has a preferred carrier or transportation method and wants control over the transportation process from the named place of delivery.

- FCA is versatile and can be used for various modes of transportation, including road, rail, air, and sea.

- FCA can be used when goods need to be handed over at specific locations like airports, terminals, or warehouses.

- FCA provides flexibility for the buyer to choose the named place of delivery, allowing customization based on the logistics requirements of the transaction.

CPT (Carriage Paid To) and CIP (Carriage and Insurance Paid To)

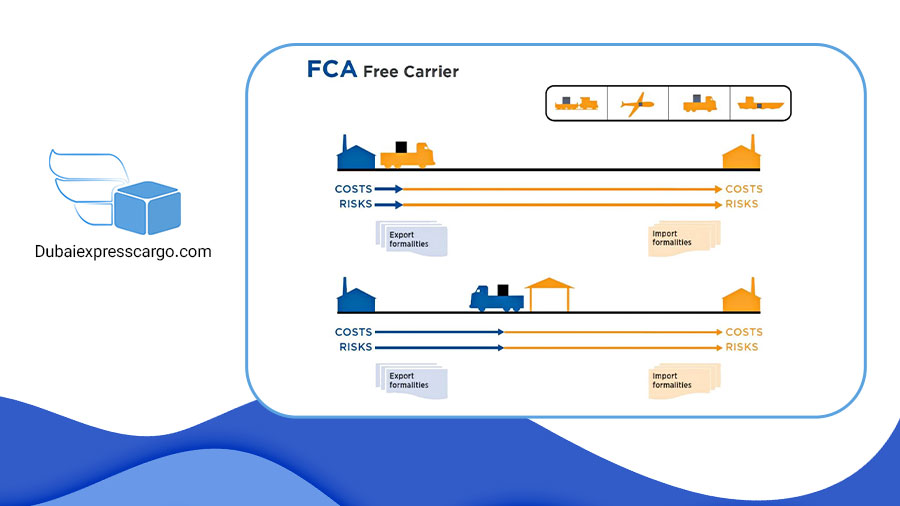

CPT (Carriage Paid To)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods to a carrier or another person nominated by the seller at a named place (usually a destination or agreed-upon location).

- The seller pays the freight charges for the carriage of the goods to the named destination.

- Buyer’s Responsibility:

- The buyer is responsible for all costs and risks beyond the named place of destination, including import duties, unloading, and transportation from that point onward.

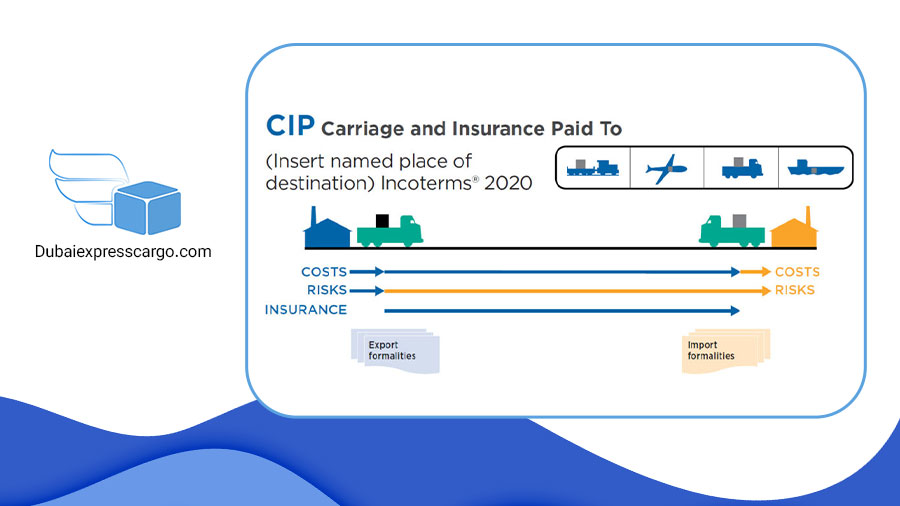

CIP (Carriage and Insurance Paid To)

- Seller’s Responsibility:

- The seller, under CIP, has the same responsibilities as in CPT (delivering the goods to a carrier at a named place and paying the freight charges).

- Additionally, the seller must procure insurance against the buyer’s risk of loss or damage to the goods during the carriage.

- Buyer’s Responsibility:

- Like CPT, the buyer is responsible for costs and risks beyond the named place of destination. This includes import duties, unloading, and transportation from that point onward.

Differentiating Between CPT and CIP

- Insurance Coverage:

- CPT: The seller is not obligated to provide insurance coverage. The buyer must arrange and pay for insurance if desired.

- CIP: The seller is required to procure insurance coverage for the buyer against the risk of loss or damage during the carriage.

- Risk Transfer:

- CPT: The risk transfers from the seller to the buyer when the goods are handed over to the carrier at the named place.

- CIP: The risk transfers from the seller to the buyer at the same point as in CPT (when the goods are handed over to the carrier), but the seller’s insurance coverage extends protection to the buyer during the carriage.

- Insurance Document:

- CPT: The seller is not obligated to provide the buyer with an insurance document.

- CIP: The seller must provide the buyer with an insurance document or evidence of insurance coverage.

- Additional Cost in CIP:

- CIP: Since the seller is responsible for obtaining insurance, additional costs may be associated with procuring insurance coverage.

Importance of Insurance in CIP

- The international shipment of goods involves various risks, including damage, loss, or theft during transit. Insurance in CIP helps mitigate these risks by providing financial protection to the buyer.

- Insurance in CIP typically covers a broad range of risks, including damage due to accidents, natural disasters, and other unforeseen events during the carriage.

- CIP provides the buyer with peace of mind, knowing that their investment in the goods is protected during transportation.

- In some cases, buyers or financing institutions may require insurance coverage as part of the contractual terms. CIP ensures that this requirement is met.

- If there is damage or loss during transportation, the buyer can initiate a claim against the insurance, simplifying the process of seeking compensation.

While CPT and CIP involve the carriage of goods to a named destination, CIP adds an important layer of protection by requiring the seller to provide insurance coverage for the buyer. Including insurance in CIP addresses the risks associated with international transportation and provides additional security for the buyer.

DAP (Delivered at Place) and DPU (Delivered at Place Unloaded)

DAP (Delivered at Place)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods to a named place agreed upon between the buyer and seller.

- The seller bears all risks and costs associated with transporting the goods to the named destination, including import duties, taxes, and other charges.

- Buyer’s Responsibility:

- The buyer is responsible for unloading the goods from the arriving conveyance (e.g., truck, ship) and for clearing the goods through customs.

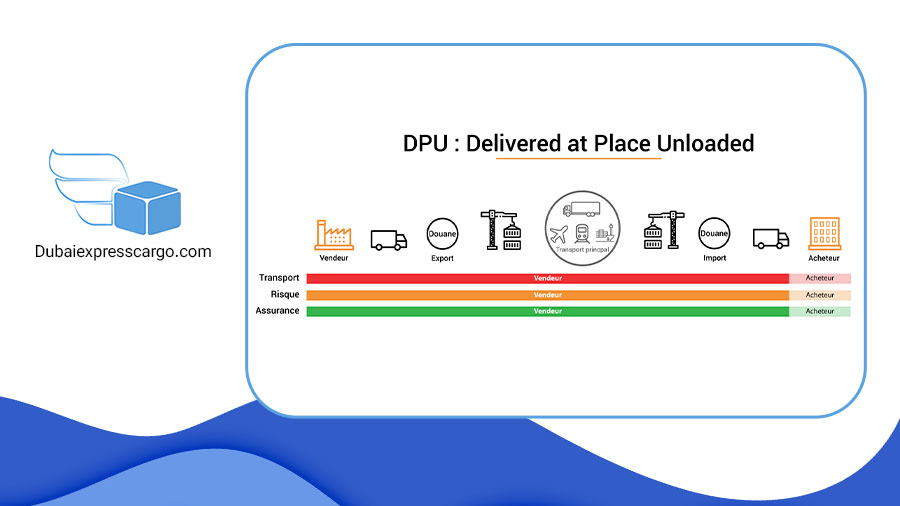

DPU (Delivered at Place Unloaded)

- Seller’s Responsibility:

- The seller, under DPU, has the same responsibilities as in DAP (delivering the goods to a named place and bearing all risks and costs of transportation).

- Additionally, the seller is responsible for unloading the goods from the arriving conveyance at the named place.

- Buyer’s Responsibility:

- The buyer is responsible for clearing the goods through customs after they have been unloaded by the seller.

Understanding Delivery Responsibilities

- DAP:

- Delivery to Named Place: The seller is responsible for delivering the goods to a specified place, typically agreed upon in the contract. This can be the buyer’s premises, a warehouse, or any other designated location.

- Risks and Costs: The seller bears all risks and costs up to the point of delivery, including transportation, import duties, and other charges.

- DPU:

- Delivery and Unloading: In addition to the responsibilities in DAP, the seller is specifically responsible for unloading the goods from the arriving conveyance (e.g., truck, ship) at the named place.

- Risks and Costs: The seller continues to bear all risks and costs until the goods are unloaded at the named place.

Considerations for Both Incoterms

- Risk Management: DAP and DPU involve a clear risk transfer from the seller to the buyer at a specific point. Understanding and managing these risks are crucial.

- Communication and Coordination: Effective communication between the buyer and seller is essential to ensure a smooth handover and unloading process.

- Legal and Regulatory Compliance: Both parties should be aware of and comply with relevant laws and regulations, especially those related to customs clearance and unloading procedures.

DAP and DPU are both designed to provide flexibility in terms of delivery locations and accommodate various scenarios where either the buyer or the seller may be better equipped to handle unloading. The choice between DAP and DPU depends on factors such as the buyer’s capabilities, the nature of the goods, and the efficiency of customs clearance processes at the named place of delivery.

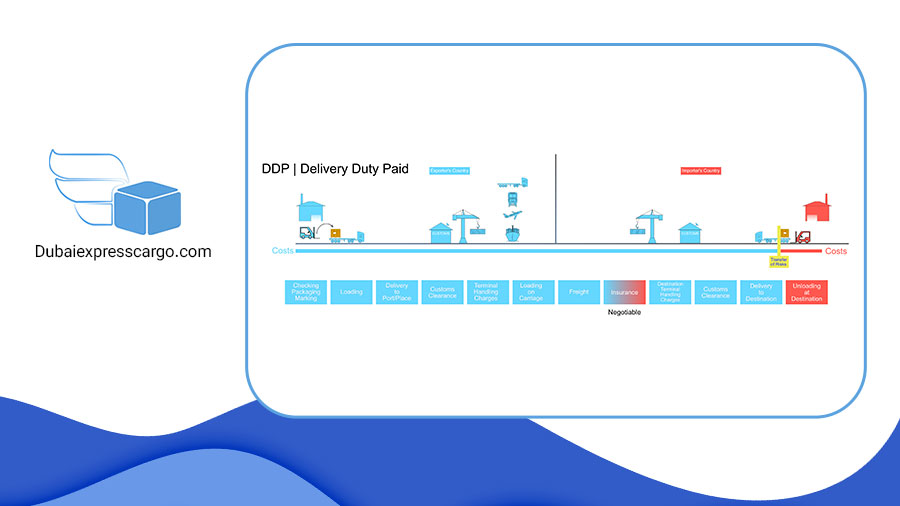

DDP (Delivered Duty Paid)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods to the buyer at the named place of destination.

- The seller must bear all costs and risks of transporting the goods to the named place, including import duties, taxes, and other charges.

- Buyer’s Responsibility:

- The buyer is responsible for unloading the goods from the arriving conveyance (e.g., truck, ship) and for clearing the goods through customs.

- The buyer also bears any additional costs and risks beyond the named place of destination.

Comprehensive Explanation of Responsibilities

- Delivery to Named Place:

- The seller is responsible for delivering the goods to a specified place agreed upon in the contract. This could be the buyer’s premises, a warehouse, or a designated location.

- Transportation Costs:

- The seller bears all costs of transporting the goods to the named place, including freight charges, handling charges, and other expenses.

- Clearance for Export:

- The seller is responsible for export customs formalities, including obtaining necessary licenses or permits.

- Import Duties and Taxes:

- The seller is responsible for paying any import duties, taxes, and customs clearance charges on the buyer’s behalf.

- Unloading at Destination:

- While the seller is responsible for transporting the goods to the named place, the buyer is responsible for unloading the goods from the arriving conveyance.

- Risk Transfer:

- The risk of loss or damage to the goods transfers from the seller to the buyer at the named place of destination.

- Customs Clearance at Destination:

- The buyer is responsible for clearing the goods through customs at the destination, including paying applicable import duties and taxes.

- Additional Costs Beyond Named Place:

- Any additional costs or risks beyond the named place of destination are the responsibility of the buyer.

Situations Where DDP is Advantageous

- Limited Buyer Experience with International Trade:

- DDP can be advantageous when the buyer has limited experience with international trade or is unfamiliar with the customs clearance process. The seller takes on the responsibility for customs clearance and associated costs.

- Time-Sensitive Transactions:

- DDP can be beneficial when time is of the essence and the buyer wants a hassle-free delivery process. The seller manages the logistics and customs clearance, potentially expediting the overall process.

- Goods with Complex Customs Requirements:

- DDP allows the seller, who is likely more familiar with local regulations, to handle the customs clearance process for goods with complex customs requirements or restrictions.

- Building Strong Buyer-Seller Relationships:

- DDP can be used strategically to build trust and strong relationships between buyers and sellers. The seller is committed to the transaction’s success by taking on a greater share of responsibilities.

- High-Value Goods:

- DDP provides a more comprehensive service for high-value goods where the buyer may not have established relationships with customs brokers or has concerns about handling customs processes.

- Ensuring Price Certainty:

- DDP provides the buyer with price certainty, as the total cost is known upfront, and there are no unexpected customs-related expenses.

- Buyer’s Preference for a Turnkey Solution:

- In situations where the buyer prefers a turnkey solution, with the seller managing logistics from origin to destination, DDP is a suitable Incoterm.

DDP is advantageous when the buyer seeks a comprehensive solution, especially when dealing with international trade complexities. It benefits buyers who may not have the expertise or resources to handle customs clearance and associated tasks, allowing the seller to provide a full-service, hassle-free delivery.

FAS (Free Alongside Ship) and FOB (Free On Board)

FAS (Free Alongside Ship)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods alongside the named vessel at the named port of shipment.

- The seller bears all costs and risks associated with delivering the goods to the port of shipment, including export duties and charges.

- Risk Transfer Point:

- The risk transfers from the seller to the buyer once the goods are placed alongside the ship at the named port of shipment.

- Buyer’s Responsibility:

- The buyer is responsible for all costs beyond the named port, including loading onto the vessel, transportation, unloading at the destination, and import duties.

- Key Consideration:

- FAS is typically used for goods transported by sea, and it requires the seller to deliver the goods to the quay or dock alongside the ship nominated by the buyer.

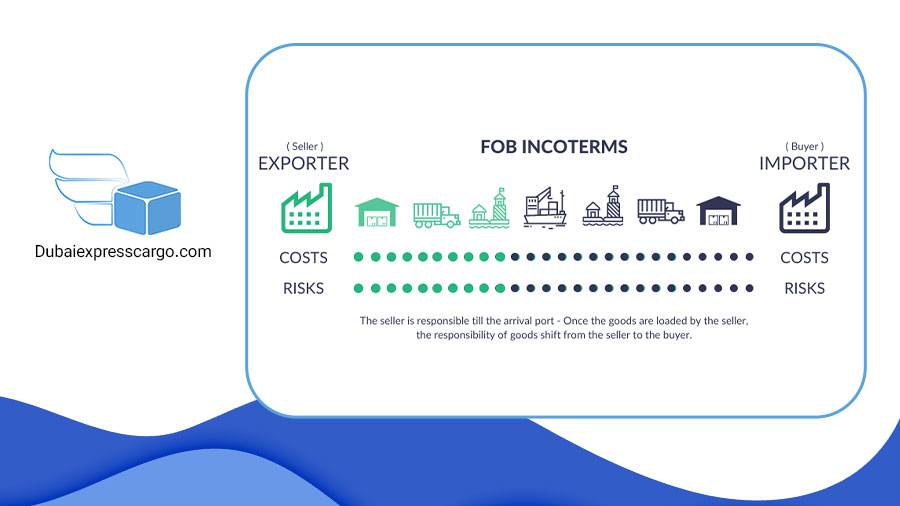

FOB (Free On Board)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods on board the named vessel at the named port of shipment.

- The seller covers all costs and risks of transporting the goods to the named port, including export duties.

- Risk Transfer Point:

- The risk transfers from the seller to the buyer when the goods pass the ship’s rail at the named port of shipment. “Passing the ship’s rail” means that the goods are considered on board the vessel.

- Buyer’s Responsibility:

- The buyer is responsible for costs beyond the ship’s rail, including loading the goods onto the vessel, transportation, unloading at the destination, and import duties.

- Key Consideration:

- FOB is widely used in maritime shipments and is often the preferred Incoterm when the buyer has more control over the shipping process and wants to choose the shipping line and route.

Clarifying Roles in Maritime Shipments:

- Delivery Location:

- FAS: The goods are delivered alongside the ship at the port of shipment.

- FOB: The goods are delivered on board the ship at the port of shipment.

- Loading Responsibility:

- FAS: The buyer is responsible for loading the goods onto the ship.

- FOB: The seller is responsible for loading the goods onto the ship.

- Risk Transfer Point:

- FAS: Risk transfers from the seller to the buyer when the goods are placed alongside the ship.

- FOB: Risk transfers from the seller to the buyer when the goods pass the ship’s rail.

- Cost Responsibility:

- FAS: The seller covers costs for placing the goods alongside the ship.

- FOB: The seller covers costs for passing the ship’s rail.

- Transportation Responsibility:

- Both FAS and FOB require the buyer to arrange and pay for transportation from the port of shipment to the destination.

FAS and FOB are used in maritime shipments; they differ in delivery location, loading responsibility, risk transfer point, and cost responsibilities. Understanding these distinctions is crucial for parties involved in international trade to avoid misunderstandings and ensure a smooth and efficient shipping process.

- Related Articles: DIFFERENT TYPES OF CARGO SHIPS

CFR (Cost and Freight) and CIF (Cost, Insurance, and Freight)

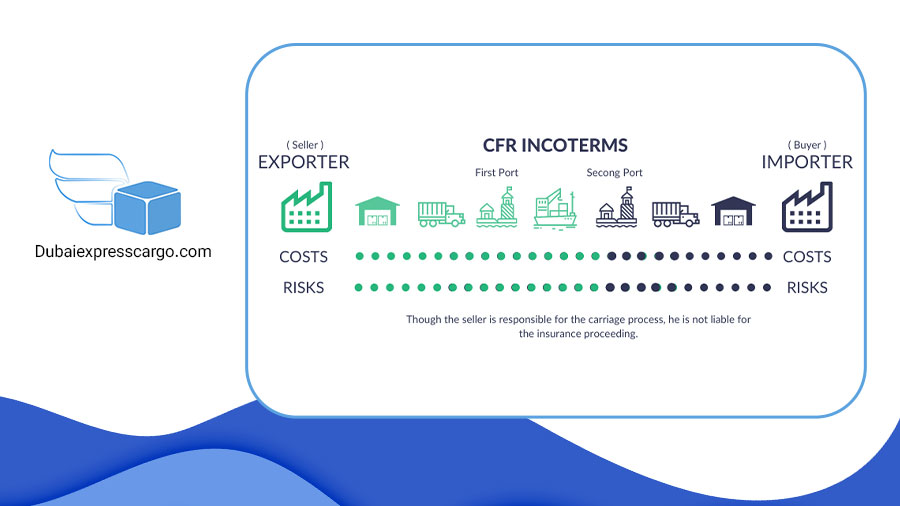

CFR (Cost and Freight)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods on board the vessel at the named port of shipment.

- The seller covers the costs and freight charges to bring the goods to the destination port.

- Buyer’s Responsibility:

- The buyer is responsible for the risk of loss or damage to the goods once they board the vessel.

- The buyer must also arrange and pay for the main carriage of the goods from the port of shipment to the final destination.

- Risk Transfer Point:

- The risk transfers from the seller to the buyer once the goods are on board the vessel at the named port of shipment.

- Insurance Responsibility:

- Under CFR, the seller cannot provide insurance coverage for the goods during transit. It is the buyer’s responsibility to arrange insurance if desired.

CIF (Cost, Insurance, and Freight)

- Seller’s Responsibility:

- The seller is responsible for delivering the goods on board the vessel at the named port of shipment.

- The seller covers the costs and freight charges and also procures insurance against the buyer’s risk of loss or damage to the goods during the carriage to the named destination port.

- Buyer’s Responsibility:

- The buyer is responsible for the risk of loss or damage to the goods once they board the vessel.

- The buyer must arrange and pay for the main carriage of the goods from the port of shipment to the final destination.

- Risk Transfer Point:

- The risk transfers from the seller to the buyer once the goods are on board the vessel at the named port of shipment.

- Significance of Insurance in CIF:

- In CIF, the seller is specifically required to procure insurance coverage for the buyer. This insurance protects the buyer against the risk of loss or damage to the goods during the carriage to the destination port.

- The insurance coverage in CIF typically includes a broad range of risks, such as damage due to accidents, natural disasters, theft, or other unforeseen events during transit.

- The importance of insurance in CIF lies in providing financial protection to the buyer and ensuring that, in the event of any damage or loss during transit, the buyer can recover the value of the goods.

Differentiating Between CFR and CIF:

- Insurance Responsibility:

- CFR: The buyer is responsible for arranging and paying for insurance.

- CIF: The seller is obligated to procure insurance for the buyer.

- Buyer’s Risk Exposure:

- CFR: The buyer assumes the risk of loss or damage once the goods are on board the vessel.

- CIF: The buyer assumes the risk of loss or damage once the goods are on board the vessel, but the insurance coverage mitigates this risk during transit.

- Insurance Document:

- CFR: The buyer is not provided with an insurance document by the seller.

- CIF: The seller must provide the buyer with an insurance document or evidence of insurance coverage.

- Additional Cost in CIF:

- CIF: Since the seller is responsible for obtaining insurance, additional costs may be associated with procuring insurance coverage.

While CFR and CIF involve the seller’s responsibility for delivering goods on board the vessel at the named port of shipment, the key difference lies in insurance provision. CIF requires the seller to procure insurance for the buyer, providing additional protection against the risks of loss or damage during transit. Buyers and sellers must clearly understand these differences to negotiate terms that align with their preferences and risk tolerance.

What are the benefits of incoterms?

Incoterms offer several benefits to parties involved in international trade by providing a standardized set of rules and terms that help facilitate smooth and efficient transactions. There are some of the key benefits:

1. Clarity and Common Understanding: Incoterms provide a common language for buyers and sellers worldwide. Using standardized terms, both parties can clearly understand their respective roles, responsibilities, and risk transfer at each transaction stage.

2. Reduced Risk of Disputes: The standardized nature of Incoterms helps reduce the risk of misunderstandings and disputes between parties. Since the terms are well-defined and widely recognized, there is less room for interpretation and disagreement over responsibilities.

3. Efficient Logistics and Supply Chain Management: Incoterms help streamline logistics and supply chain processes by clearly defining the point of delivery, transfer of risk, and responsibility for transportation costs. This clarity contributes to smoother coordination and execution of international shipments.

4. Cost Savings and Predictability: Both buyers and sellers can better plan and manage their costs by understanding who is responsible for various expenses such as transportation, insurance, and customs clearance. This predictability allows for better financial planning and cost control.

5. Global Consistency: Incoterms provide a globally accepted framework, especially important in international trade. This consistency facilitates trade across borders and ensures that parties from different countries can engage in transactions with a common understanding.

6. Facilitates Compliance with International Regulations: Incoterms help ensure that transactions comply with international regulations and standards. They consider factors such as customs clearance, export/import regulations, and other legal requirements, contributing to smoother cross-border trade.

7. Flexibility to Choose Appropriate Terms: Parties can choose the Incoterms that best suit their needs and the transaction specifics. The terms can be selected based on factors such as the mode of transportation, the level of risk parties are willing to assume, and the desired level of control over the logistics process.

8. Risk Management: Incoterms clearly define when the risk of loss or damage to the goods transfers from the seller to the buyer. This clarity allows parties to manage and mitigate risks effectively through insurance coverage or other risk management strategies.

It’s important to note that while Incoterms provide a valuable framework, they do not cover all aspects of a sales contract. Therefore, parties should complement Incoterms with a detailed and comprehensive international sales agreement to address other important terms and conditions. Additionally, staying informed about updates to Incoterms is crucial, as they may be revised periodically by the International Chamber of Commerce.

Tips for Choosing the Right Incoterms

Choosing the right Incoterms is a crucial aspect of international trade and requires careful consideration of various factors. Here are some tips for selecting the appropriate Incoterms for your transactions:

1. Assessing the Mode of Transportation:

- Different Incoterms are more suitable for specific modes of transportation. For instance, EXW, FCA, and FOB are often used for sea freight, while DAP and DDP are common for air freight and road transport. Understanding the transportation method is key to selecting the right Incoterms.

- Consider Incoterms that provide clarity and coverage across various journey stages for complex or multi-modal transportation. Some terms, like CIP (Carriage and Insurance Paid To) or DAP (Delivered at Place), may be more versatile for such scenarios.

2. Considering Risk Tolerance:

- Incoterms are defined when the risk of loss or damage transfers from the seller to the buyer. Assess your risk tolerance and choose Incoterms accordingly. For instance, if you want more control over the shipment and are comfortable assuming risks, you might opt for terms like FCA or EXW. If risk mitigation is a priority, consider terms like CIF or DDP, where the seller takes on more responsibilities.

- If risk mitigation is a priority, consider Incoterms that involve the seller providing insurance coverage, such as CIF or CIP. This can be particularly important for high-value or sensitive goods.

3. Evaluating Control Over Logistics Processes:

- Consider the capabilities and resources of both the buyer and the seller. If the buyer has a well-established logistics network and customs expertise, they may prefer terms that give them more control, such as FCA or EXW. On the other hand, if the seller has a more efficient supply chain, terms like DDP or DAP might be suitable.

- Effective communication and coordination between the buyer and seller are critical. The chosen Incoterms should align with the capabilities and preferences of both parties. Clearly define responsibilities to avoid misunderstandings.

- Evaluate the complexity of customs clearance processes. Suppose the buyer has experience and knowledge of local customs regulations. In that case, they might prefer terms that involve more control, such as FCA. If the seller is better positioned to handle customs procedures, terms like DDP or DAP may be appropriate.

4. Specific Considerations for Certain Incoterms:

- If insurance coverage is critical, consider terms like CIF (Cost, Insurance, and Freight) or CIP (Carriage and Insurance Paid To), where the seller is responsible for providing insurance.

- Some terms, like EXW (Ex Works) and FCA (Free Carrier), place more responsibility on the buyer for loading and unloading. These terms might be suitable if the buyer has the capability and facilities for these tasks.

5. Legal and Regulatory Compliance:

- International trade regulations can change, affecting the applicability and suitability of Incoterms. Stay informed about legal and regulatory requirements in both the seller’s and buyer’s jurisdictions.

- While Incoterms cover many aspects of a transaction, they may not address all specific requirements. Consider complementing Incoterms with additional agreements or clauses to ensure comprehensive coverage.

Choosing the right Incoterms requires a thoughtful analysis of the transaction’s specific characteristics, the parties’ capabilities, and the desired level of control and risk distribution. Clear communication and a detailed understanding of the chosen terms are essential for a successful international trade transaction.

Staying Informed: Updates to Incoterms

Keeping up to date with the latest version of Incoterms is crucial for international trade practitioners, as it ensures that contractual terms accurately reflect industry best practices and any changes in international trade regulations. Here’s why staying informed is essential and resources for accessing the most recent information:

1. Evolution of International Trade Practices:

- Incoterms are periodically updated to align with modern trade practices and respond to changes in the global economic landscape.

- Revisions consider transportation, technology, and logistics advancements to provide clearer and more relevant guidance for international trade transactions.

2. Legal and Regulatory Compliance:

- International trade regulations and laws evolve. Incoterms updates may incorporate changes to ensure terms comply with the latest legal requirements.

- Staying informed about the latest version helps mitigate the risk of using outdated terms that may not reflect current legal standards, potentially leading to misunderstandings and disputes.

3. Emphasis on Specific Responsibilities:

- Updated Incoterms often clarify responsibilities for buyers and sellers, reducing the risk of misinterpretation and disputes.

- Changes in the global business environment, such as shifts in risk management practices, are considered in updates to ensure that Incoterms remain relevant.

4. Importance of Staying Current:

- Incorrectly applying outdated Incoterms can lead to financial and legal consequences. Staying current ensures that the chosen terms accurately reflect the parties’ intentions.

- Consistent use of the latest Incoterms version facilitates effective communication and understanding between parties, reducing the likelihood of disputes arising from differences in interpretation.

- Knowledge of the latest Incoterms version enhances negotiation capabilities, allowing parties to make informed decisions based on industry standards.

5. Resources for Accessing the Most Recent Information:

- The ICC is the organization responsible for publishing Incoterms. Access the ICC website for the latest information, updates, and resources related to Incoterms. The official ICC website is the most authoritative source for the latest versions.

- The ICC periodically releases new editions of Incoterms, with detailed explanations and guidelines. These publications provide valuable insights into the correct application of Incoterms in various trade scenarios.

- Participating in ICC-organized training sessions, webinars, or seminars can provide in-depth understanding and practical insights into using Incoterms.

- Legal and trade publications often cover updates to Incoterms. Following reputable sources can help you stay informed about changes and interpretations.

- Industry-specific professional associations and organizations may provide updates and resources related to Incoterms. Engaging with these associations can provide valuable insights into the practical application of Incoterms in specific industries.

Conclusion

In conclusion, understanding and effectively applying Incoterms in international trade is vital for the success of cross-border transactions. Incoterms provide a standardized set of rules that define the responsibilities and liabilities of buyers and sellers at different stages of the shipment process.

Mastering Incoterms enhances international trade transactions’ efficiency, transparency, and reliability. Whether you are a buyer, seller, or logistics professional, a comprehensive understanding of Incoterms contributes to successful and mutually beneficial trade relationships.

Regular training, access to official resources, and ongoing education about updates are key practices in navigating the complexities of international trade using Incoterms.